Not known Details About Dubai Company Expert

Dubai Company Expert - The Facts

Table of ContentsSome Known Details About Dubai Company Expert Dubai Company Expert Can Be Fun For EveryoneDubai Company Expert Things To Know Before You Get ThisIndicators on Dubai Company Expert You Need To KnowDubai Company Expert - QuestionsUnknown Facts About Dubai Company ExpertThe 5-Minute Rule for Dubai Company ExpertHow Dubai Company Expert can Save You Time, Stress, and Money.

The webhosting you select is an essential factor to consider too. You can have an excellent web site, but it will certainly do you no great if your host has excessive downtime or if the speed of surfing your site is also slow-moving. Along with taking a look at reviews online, think about asking your personal as well as business network calls.

Depending upon the items or services you'll be offering, you will certainly also need to examine as well as pick your sources of supply and also inventory, along with how you will certainly deliver your service or product to your consumer. Again, a number of choices are offered. Offered the significance of having supply on handor a good on-demand providerand a dependable approach of fulfillment, spending sufficient study time on this aspect can indicate the distinction in between success and failing.

The Definitive Guide for Dubai Company Expert

The 10-year advantage period is connected to the startup NY organization, not private workers. A qualified worker will only get 10 years of the wage exemption advantage if he or she is worked with prior to July 1st in the Startup NY service's very first year of involvement in the program as well as stays utilized for the entire 10-year period.

No, a staff member worked with for a web new task should be on the pay-roll for a minimum of 6 months of the fiscal year at the TFA place before being qualified for the wage exclusion benefit. He or she will certainly be qualified for the wage exclusion benefit in the following schedule year gave she or he is used in the TFA for at the very least 6 months during that fiscal year.

Dubai Company Expert - An Overview

As long as the staff member was employed for at the very least 6 months in the calendar year, she or he may preserve the wage exclusion benefit for the year. However, he or she will certainly not be eligible for the benefit in succeeding years unless business go back to compliance (Dubai Company Expert). No, a worker is not called for to reside in New york city to be qualified for the wage exclusion benefit.

In enhancement to various other standards, the Economic Advancement Regulation defines a web brand-new job as one "createdin a tax-free NY area" and also "brand-new to the state." Jobs produced according to an application accepted by ESD but not yet located in a TFA will certainly be considered web brand-new work only under the complying with conditions: It is business's preliminary year in the program; The jobs stay outside the TFA right into which business will be locating since no ideal room exists within such TFA; The work are relocated into the TFA within 180 days after business's application is approved; The jobs are created after the organization's application is authorized by ESD; Tax benefits would certainly not begin until business finds to the Tax-Free Location, with the exemption of the sales tax credit score or refund.

The Best Guide To Dubai Company Expert

The companies can not report those earnings as STARTUP NY wages until business situates to the Tax-Free Area. The request for a 180-day waiver ought to be made at time of application entry however must be made before the production of any type of net brand-new work subject to the waiver. A "net brand-new task" implies a work produced in a Tax-Free NY Area (TFA) that pleases all of the adhering to standards: is new to the State; has actually not been transferred from work with one more business situated in this State, through a purchase, merger, combination or various other reorganization of organizations or the procurement of assets of an additional company, or has actually not been moved from employment with a related individual in this State; is not filled by an individual utilized within the State within the right away preceding 60 months by a relevant person; is either a full time wage-paying work or equal to a full-time wage-paying task requiring at least 35 hours each week; and also is filled for even more than 6 months In order to accomplish the six month need, a business needs to recognize the precise day when it situates to the TFA (AREA DATE).

Yes, a new task situated at a TFA location that is filled on or after the day a company is certified to take part in the Program will be counted as a web new work for functions of satisfying its work performance objectives as long as that job stays filled up for a minimum of six months of the 12-month period starting on the date that business situates to a TFA and/or 6 months out of each subsequent 12-month period, as well as it satisfies all the various other internet brand-new work requirements.

The Main Principles Of Dubai Company Expert

The go to the website internet brand-new task would merely be inhabited by a various person. To figure out whether a work created by a business joining the START-UP NY Program in a TFA can be taken into consideration a "internet new job", business should want to the job (not the person) and also the function of the task to see if it qualifies as a "internet brand-new task".

If an independent service provider was worked with to execute a task feature for the STARTUP NY organization and also did the job exclusively for the company permanent (that is, did not use these services to the basic public) and also was then useful site employed by the business into the very same position doing the very same job functions, the placement filled by the independent contractor would certainly not be counted as a net new task as the placement would certainly be interpreted as having been formerly been executed in the state and hence not brand-new.

The Best Strategy To Use For Dubai Company Expert

Prior to we study the information of organization enrollment, a please note: what we're supplying right here is a fundamental introduction of the basic demands for a lot of organizations in the USA. If you run globally or operate in some specific niche market like long-haul tobacco as well as airplane fuel shipping, these guidelines are one hundred percent guaranteed not to cover everything you require to know regarding registering your service. Dubai Company Expert.

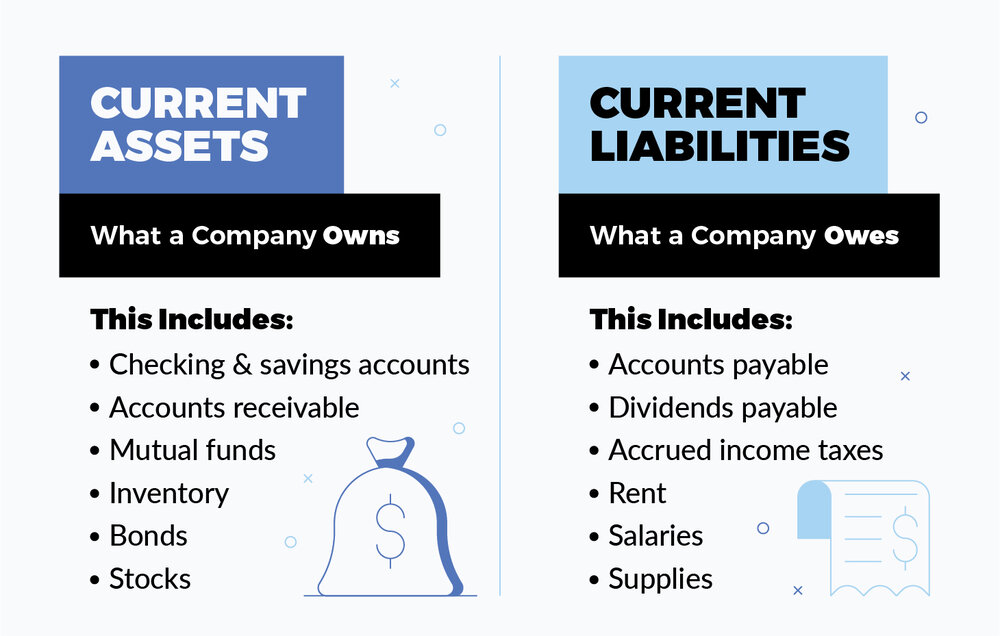

It suggests that you are the business, and also check my reference all properties and also financial debts for the firm are yours too. This additionally suggests you'll be directly responsible for all company obligations like legal actions or debts, so this is the riskiest service structure. These are like single proprietorships, except there's greater than one owner.

Not known Facts About Dubai Company Expert

With your organization plan in hand, it's time to lay the operational and economic foundation to get your company off the ground.

The Of Dubai Company Expert

If you sell physical items and you run in a state that accumulates sales tax obligations, you likely need to sign up for a Sales Tax Permit. A lot of states carry out these authorizations totally free or for a nominal cost. Money can obtain made complex extremely quickly, so you intend to have an automated system for economic bookkeeping, budgeting, and paperwork prior to you start making any kind of sales.